Financial Planning and Wealth Management form the two pillars of Personal Finance. The Former being the navigation map and the Latter being the journey & the destination.

At Solomon Investments, we pay detailed attention to what our clients needs and goals are. We develop action plans to grow their wealth by making sound financial decisions.

Thus we ensure that our client’s Map is in place and they have a smooth journey without any headwinds.

Financial Planning is the most Important but widely Ignored Activity every Household requires.

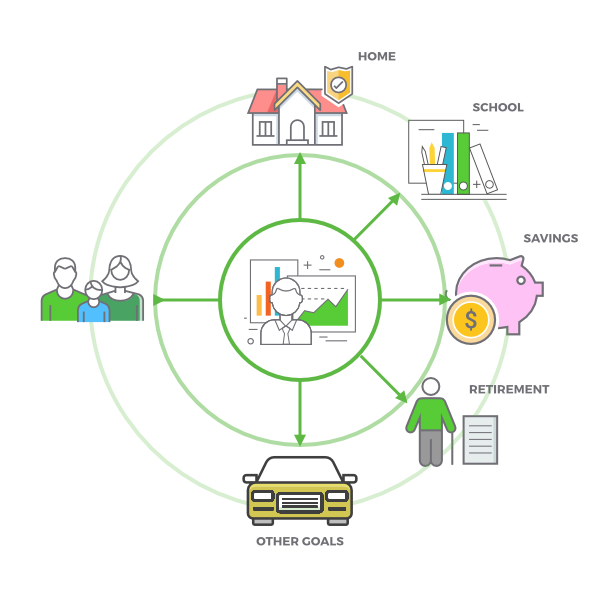

A Financial Plan is the link between your Financial Resources and your Life goals.

Financial Decisions such as buying a car, purchasing a flat, building a corpus for our kids education, investing for retirement requires careful assessment of our current income/expenses and saving plus investing for them without depleting our current standard of living.

A Financial Plan will help you analyse what you can achieve and build the necessary foundation required for achieving your life goals.

How we can help

- To develop a Cashflow Management Strategy where we can track your income & expenses. This will allow us to plan for future expenses and ways to create investments to meet your needs and goals.

- To develop your Comprehensive Insurance portfolio so that you and your loved ones remain adequately protected in times of unforeseen life events.

- To develop a Customized Tax Plan where we find possible ways to reduce your tax availability within the scope of the Income Tax Laws and Regulations.

- To develop a Comprehensive Investment Plan by recommending short term and long term investment ideas which will be in line of your Financial Goals. Financial Goals can be Saving for you Retirement, funding your child’s education, Emergency Fund planning etc.

SI Financial Planning Process

In the first meet, we will understand what is your idea of a Financial Plan and accordingly educate you about Financial Planning and its process. We will also note down your Life goals/dreams to understand you better. The first meet is always free of charge.

After the first meet, if you decide you need a financial plan, a Letter of Engagement will have to be signed. A Letter of Engagement is draft stating the responsibilities of The Client and The Financial Planner. It contains the Financial Planning fees, services, duration etc. agreed at the start of the Financial Plan.

Once the Letter of Engagement is signed, we will understand your financial status, your Income sources, your responsibilities to your family and your dreams for which you need to save and invest.

We will also understand your hobbies and lifestyle which plays an important role in developing a Financial Plan.

All this Information will be collected by us in a data sheet during this meet.

After Gathering the Information we will:

- Analyse your Current Financial Situation

- Help you in Finalize your Financial Goals

- Prepare your Current Cash Flow Statement & Net Worth Statement

- Develop strategies and make recommendations on which financial products are needed. These recommendations would be on maintenance of Contingency Fund, Risk Management & Insurance Planning, Loans / Debt Management, Investment Planning, Retirement Planning, Tax Efficiency Plan and other recommendations.

After preparing the plan, the next step is implementation of the financial plan. This is the most important step as a Financial Plan not implemented is just a piece of paper for the client.

You can either implement the plan through us or on your own. If you do decide to implement it on your own, this would have to be mentioned in the Letter of Engagement.

In a review meeting we discuss the changes that have occurred in your life, changes could be in lifestyle, health and career, changes in family such as marriage, birth or death, financial goals.

We also will access changes in your financial health across income, expenses, assets (investments) and liabilities (borrowings). Besides review meetings, we can communicate as and when required with respect to the financial plan.

First year fee for SI Comprehensive Financial Plan is 15,000 / -*

Renewal year fee for SI Comprehensive Financial Plan is 8,000 /- *

*Fees are subject to change as per management. Clients/Prospective Clients will be intimated if there are any changes in the fee structure. Thank you for trusting us.

Ready to get started?

Don’t hesitate to contact us for any kind of information

Registered Address

102, Twinkle Apartments,

1st Floor, Opp. State Bank of India,

Vakola,

Santacruz East,

Mumbai-400055